Estate Planning

GoodTrust, Association On Aging In NY State Produce Joint Webinar

GoodTrust is excited to produce an upcoming estate-planning webinar, May 4, for the Association on Aging in NY State as part of its Lunch & Learn series. The webinar will target the hundreds of small businesses, nonprofits, and other organizations that are empowered to promote independence, preserve dignity, and advocate on behalf of aging New Yorkers and their families. It's also open to anyone to join and please reach out to [email protected].

The live event will be facilitated by GoodTrust co-founder and CMO, Daniel Sieberg, and GoodTrust Business Development Manager, Robyn Sechler. The focus will be not only how online tools can enable a greater adoption with estate planning and help close the wealth gap including in underrepresented communities, but also to highlight the need within New York state.

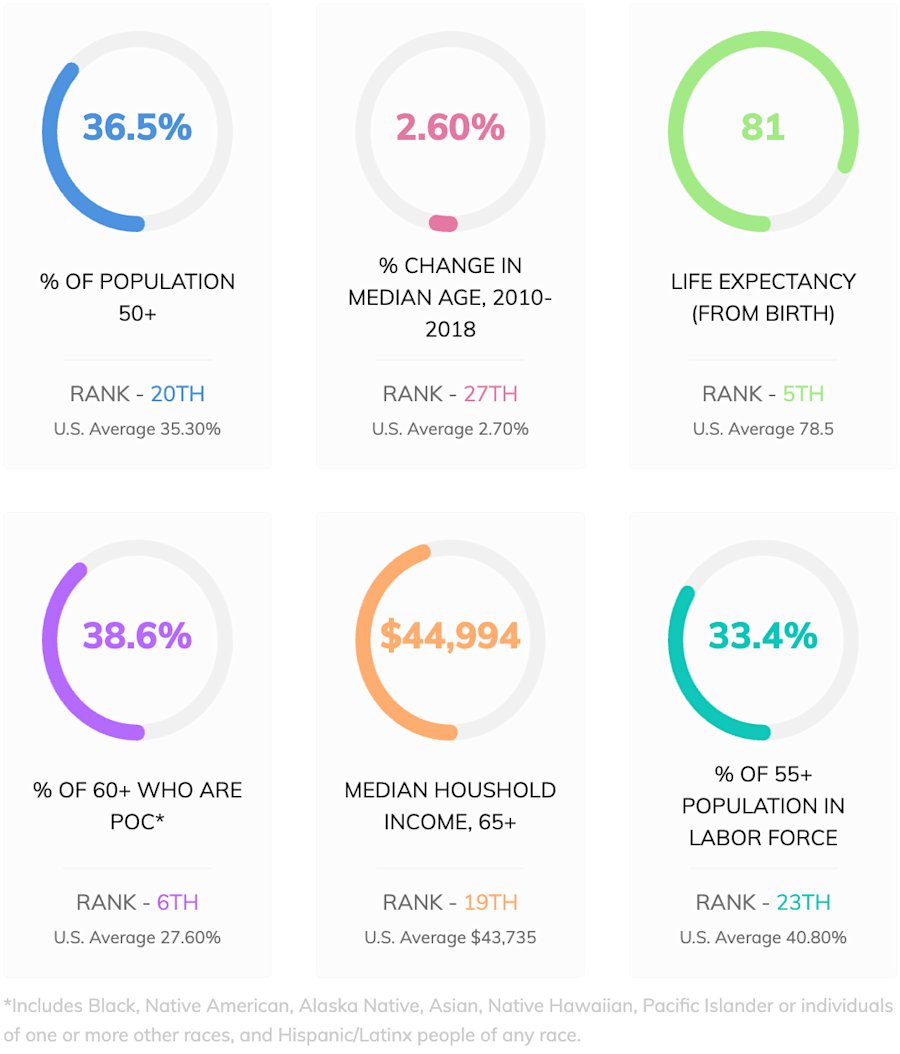

Data about aging in NY state

What happens when you die without a will in NY state?

For a New York resident without a will, a surviving spouse inherits the entire probate estate if there are no children or other descendants. If there are descendants, then the surviving spouse gets the first $50,000 and the balance is divided one-half to the spouse and one-half to the decedent's descendants.

The New York Estate Tax

While New York doesn’t charge an inheritance tax, it does include an estate tax in its laws. The state has set a $6.58 million estate tax exemption (up from $6.11 million in 2022), meaning if the decedent’s estate exceeds that amount, the estate is required to file a New York estate tax return. The state government requires that these be filed within nine months of the deceased’s death, though extensions are available. The highest tax rate you could possibly pay is 16%. (SmartAsset)

New York State Will Stats

Making a will in NY is fairly straightforward (you can start yours today):

Probate time ranges between 7-9 months for simple estates

Digital signatures are allowed

There is an estate tax (detailed above) for medium sized to large estates

The Revised Uniform Fiduciary Access to Digital Assets Act or RUFADAA has been adopted in NY state (beyond protecting your assets and your minor children, a digital legacy can also be part of anyone's estate)

You do not need to notarize your will in NY state

New York City Stats

With about 1.2 million New York City residents 65 and over—and 162,000 who are 85 and up—only 41,000 people live in nursing homes in the five boroughs. (CityLimits.org)

Across the U.S. - The Digital Legacy Gap

67% of American adults do not have a will

35% of white adults have a will.

29% of Black adults have a will.

27% of Hispanic adults have a will.

The numbers add to a singular mission for GoodTrust: let's work together to democratize estate planning and ensure families can protect what matters.

We want to thank the Association on Aging in NY State for their collaboration to reach as wide an audience as possible. The webinar will be recorded and shared following the event May 4 at 11a ET.