Estate Planning

Estate Planning For Millennials

Millennials have gotten called technology-savvy and ambitious, but they’ve also been called broke and bad at handling money. It turns out, Millennials are more likely to have an estate plan than older generations. According to a Northwestern Mutual’s study, 58% of millennials have comprehensive estate plans in place which is more than Generation X and Baby Boomers.

Millennials, born between 1981 and 1996, now represent the biggest portion of the US population at 22% (Statista). In their lifetimes, Millennials have lived through some tough stuff, from 9/11 to the pandemic. These events have made them resilient, adaptable, and more invested in estate planning. Millennials want to do things by themselves and do them right, 52% of them believe do-it-yourself estate planning is the way to go, as opposed to 40% of Generation X and 27% of Baby Boomers (Northwestern Mutual).

Now hitting major life milestones like having children, buying homes, and starting businesses, Millennials are also introducing new levels of care and concern in the following areas:

Wealth Transfer

In 2022, more than half of Millennials made a New Year’s resolution surrounding finances and outside of the 22% of them already working with a financial advisor, 49% of the remaining were considering seeking advising in 2022 (BusinessWire).

78% of Millennials believe in the importance of building multigenerational wealth, as opposed toony 45% of older generations

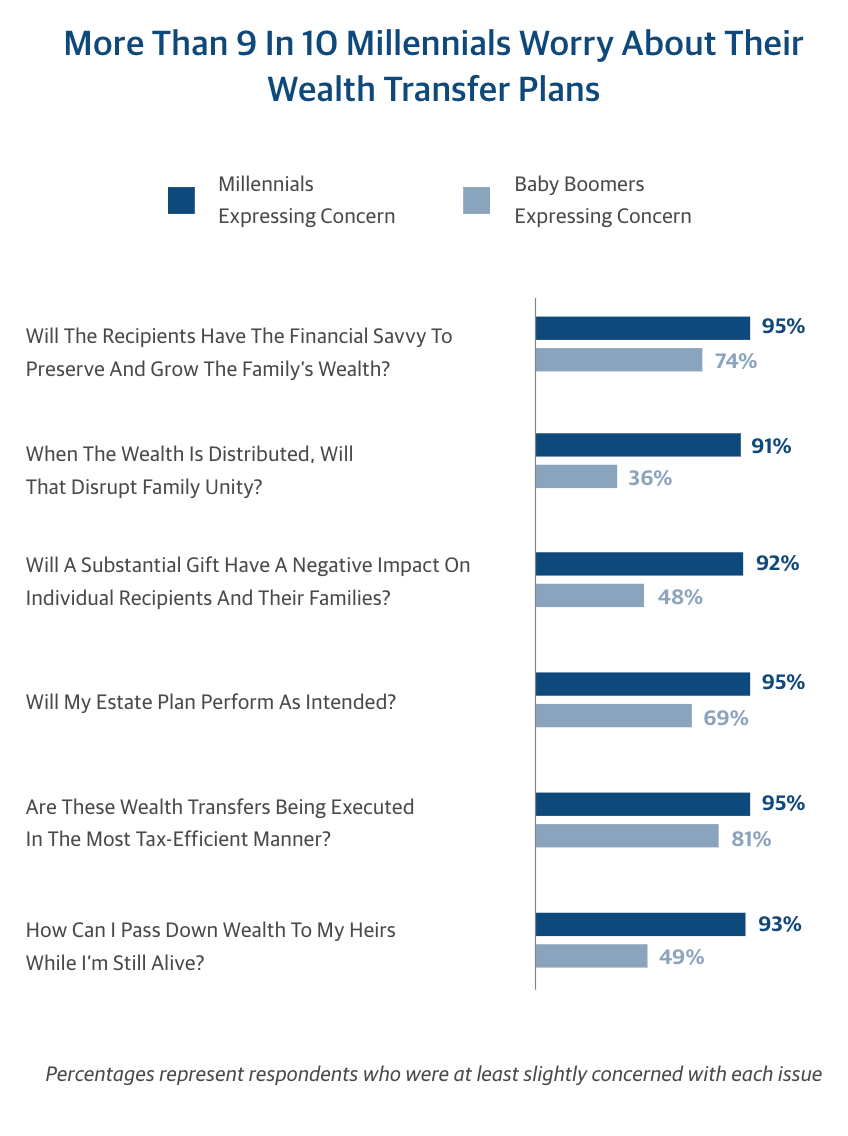

Millennials express great concern about how they ought to distribute the wealth they generate, how it will be managed once they are gone, and whether or not their heirs will be able to continue to grow it.

Digital Identity

Unlike previous generations, Millennials grew up with technology, they began building their online identities in highschool and have interacted with all iterations of social media, from myspace to instagram, and built all sorts of online accounts, from gaming to investing. These accounts matter to them and they are taking the steps to make sure they are preserved in the way they intend once they are no longer here to keep them active.

Of those who have an estate plan, 74% of Millennials appointed a digital executor to handle their digital assets

Millennials are private and are 29% more likely to want to keep their online data away in the right hands, away from their families

Millennials have specific estate planning needs and GoodTrust is perfectly equipped to handle their evolving needs.

How GoodTrust Can Make a Difference

At GoodTrust, we believe in providing modern estate planning tools that are accessible, affordable, and comprehensive. Our Estate+ Plan includes all the documents necessary to putting together a robust estate plan.

Last Will and testament is a legal document in which you outline your wishes for how your property, assets, and

Revocable Living Trust

Financial Power of Attorney

Advance Health Care Directive

Funeral Directive

Pet Directive

Digital Vault - secure your digital assets

You read that last one right, at GoodTrust we are particularly invested in providing you with the set of tools you need to make sense of, organize, and distribute your digital assets.

When It Comes to Generational Wealth

At GoodTrust, we believe in providing you with the tools you need for you and your family. Creating your will or trust and clearly outlining how you wish your assets and property to be distributed between your heirs and beneficiaries is an important steps towards ensuring that your wealth will pass down to your family in the way you intend. The main difference between a will and trust is that a trust allows you to avoid probate while directly transferring ownership of your assets to your designated beneficiaries. Learn more about the differences between these estate planning documents, here. Amongst the various things you can add to your trust, from real estate property, personal property, and more, here are the types of financial assets you can add to your trust:

Bank Accounts

Cryptocurrency

Investment Assets

Company stocks and bonds

Life Insurance Policy

When It Comes to Digital Legacy Planning

In today’s day and age, a lot of what we hold dear only exists digitally, from texts and emails to valuable photos and videos. At GoodTrust we believe in providing you with conveniently organize your digital accounts and documents, assign trusted contacts to handle your digital affairs once you are no longer able to, safeguard your passcodes, and more. These tools allow you to protect and pass down the digital assets that matter to you and your family. Our Digital Vault allows you to keep track of and pass on your valuable digital assets by providing the following services:

Sort and provide access to your online accounts

Sort and provide access to your devices

Organize and provide access to your documents

Assign trusted contacts

Learn more about how GoodTrust is the perfect fit for all your Digital Legacy needs by listening to our Co-founders’ audiobook: Digital Legacy: Take Control of Your Online Afterlife.

At GoodTrust, we are on a mission to democratize estate planning, making it accessible, affordable and, most importantly, comprehensive so you can ensure all your assets are accounted for, even your digital ones. If you are a Millennial and have yet to create your estate plan, it’s time to catch up and embark on your estate planning journey today by creating your GoodTrust account, here.