Estate Planning

Create Your Trust in 7 Easy Steps

Congratulations on taking this step in your estate planning journey! Creating your trust will bring you peace of mind, knowing your wishes are properly recorded and your loved ones are protected. We’re here to make it as easy as possible so you can get back to doing what you love: living!

At GoodTrust, we’re dedicated to making estate planning easy, accessible and intuitive. Our document-creation tools are designed to take you step-by-step through each section to ensure all your information is properly inputted. Let’s review each of the important sections of your trust.

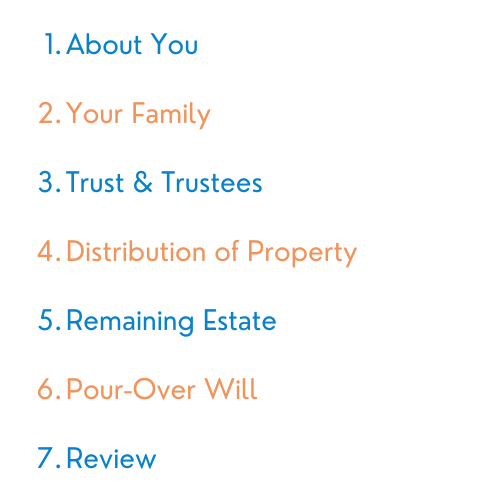

The 7 Easy Steps To Create Your Trust With GoodTrust

1. About You

It’s your trust so let’s start with you. In this initial section, you’ll be asked to input your basic information such as your name, email address, birthday, phone number, and address.

2. Your Family

Next, you’ll be asked to input some details about your family. In this section, you’ll be able to state your marital status, if you have children and pets, and more. Our trust-creation tool makes it easy for you to appoint guardians for your children under 18. Learn more about how to choose the right guardian for your minor children, here. For pets, you’ll provide details regarding your pet, and you’ll be able to appoint a guardian as well as a backup choice should anything happen to your preferred guardian.

3. Trust and Trustees

In this section, you’ll name your trust, as well as decide who will be your primary and successor trustees. By default your trust will include your name and the date of creation. Trusts are named so that they may hold title to property and assets. Once that’s done, you’ll select your primary trustee. It is common for the primary trustee to be you. This trustee retains ties and responsibilities over the property and assets within the trust. Here, you may choose to add a co-trustee. You may also choose to name someone other than yourself or a company as the primary trustee.

Your successor trustee is the person who will carry out the terms of your trust after you are no longer here to regain control over it. It’s important you pick someone you trust who is willing and able to carry out the terms of your trust. You’ll be prompted to provide their name and address. You may add an alternate successor trustee as an added layer of protection should anything happen to your preferred successor trustee. You may choose to name a company to carry out the terms of your trust.

4. Distribution of Property

In this section, you’ll be able to allocate specific assets to appointed beneficiaries. Consider family heirlooms, tokens, electronics, and other personal items. You’ll also be able to indicate how you’d like each specific distribution to be handled should anything happen to your preferred beneficiary. Choices include the beneficiary’s descendants, residuary property of the trust, another beneficiary, and charity.

This section also allows you to indicate at what age beneficiaries should receive their distribution. If you have children, this can be a great tool to control how and when they receive this inheritance. Keep in mind that the age must be over 18 in most states.

To wrap this section up, you’ll also need to indicate whether you’d like your trustees to manage your digital assets after your death. Digital assets include everything from your online accounts (social, financial, etc.) to your digitally saved documents.

5. Remaining Assets

This section allows you to divide the remaining of your estate between your chosen beneficiaries. You will also be prompted to indicate how you’d like the residuary shares to be handled should your preferred beneficiaries not survive you. Think of your remaining estate as everything that is not specifically mentioned in your “distribution of property” section.

6. Pour-Over Will

A pour-over will ensures that any assets that are not already in the trust are transferred into the trust upon your death. This is an important step in your estate plan to help make sure your wishes are properly recorded and respected. Here, you’ll decide if you’d like your successor trustee to also be the executor of your will or if you’d prefer to assign someone else.

7. Review

This final section allows you to review all the information you’ve inputted throughout the trust-creation process. We recommend that you take the time to carefully read through each of your entries, from your personal information to your estate allocation to make sure everything is correct and in accordance with your wishes. Once you’ve confidently reviewed your trust, you may save and finish.

What Happens Now?

It’s that easy! Once you’ve completed your trust, you’ll be able to download it.

Please note you will need to legalize your trust according to your state's laws in order to make it legally enforceable. This may include needing witnesses and/or notarization. Find out how to make your trust legal by referring to our "How to Make Your Wills & Trusts Valid in Your State" article.

At GoodTrust, we're dedicated to making things as easy as possible for you which is why we offer you the tools you need to keep track of your assets after you complete the initial step of your trust journey. Once you finish your trust using our intuitive document creation tool, you'll be directed to download your estate plan. Within your estate plan you will find the following helpful tools:

Instructions to your trust - think of this as your checklist to guide you through the important steps from signing to funding.

Digital Vault Instructions - this page will show you how to easily upload your completed trust to our Digital Vault. This ensures your important documents stay protected and offers the flexibility to share them with your loved ones, so they know where to locate them when necessary. Get started with our Digital Vault, here, and find out just how much you can safely store.

Schedule A Form - this form allows you to clearly state which assets you've transferred into your trust. You'll be able to detail the name, description, value, and beneficiary of each property item to make sure you and your loved ones know exactly what's in your trust.

Funding Guide - once you've created your trust, you need to fund it, which means transferring your property and assets into the trust's name. This may sound complicated, but this step-by-step guide will ensure you know exactly how to transfer your various property and assets, from family heirlooms to real estate, into your trust.

We also throw in a few additional helpful tips so you can feel comfortable knowing you're taking the right steps in securing your legacy.

We understand choosing a trust is a big decision especially as it allows you to do so much. With any estate planning decision, we recommend that you consult your loved ones, ask them questions, and work through your decision-making process with them to ensure you are confident with your choices. Learn more about trusts, here.

In order to create a robust estate plan, you'll want to consider creating the following important documents as well. Please note all of the following are included in our Estate+ plan:

Start your trust today! Click here to begin.