You Created Your Trust: Now What?

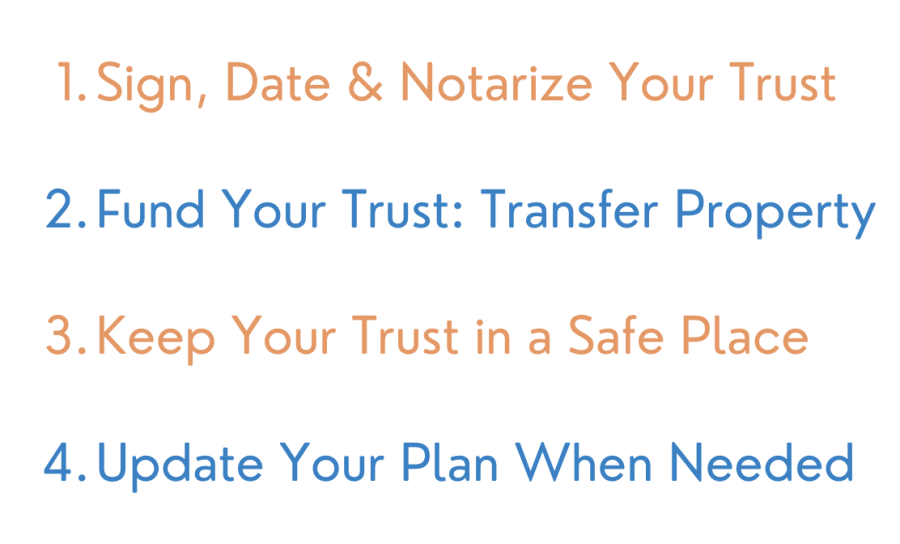

Congratulations on creating your trust, what an exciting time! Now that you've successfully recorded all your wishes, it's time to make sure your trust is legally enforceable so that you can be certain your loved ones will be protected if anything should happen to you.

Creating a trust and ensuring its legal enforceability takes a few steps. As you may know, trusts may have certain benefits such as avoiding probate and lowering estate taxes. This is made possible by the fact that trusts hold property in their name making it easier to transfer ownership once the primary trustee (trust-creator) is no longer here. This step-by-step process will help you make sure you complete all the necessary requirements so your trust and its reputation will unfold smoothly in accordance with your wishes.

Once you’ve created your trust with us, you will be able to download it along with various tools to help you navigate your next steps. These tools include:

Instructions to your trust - think of this as your checklist to guide you through the important steps from signing to funding.

Digital Vault Instructions - our Digital Vault allows you to keep your important documents, passcodes, passwords, and more safe and easily shareable with loved ones and trusted contacts. Get started, here, and find out just how much you can safely store.

Schedule A Form - this form allows you to clearly state and keep track of which assets you've transferred into your trust.

Funding Guide - once you've created your trust, you’ll need to fund it, which means transferring your property and assets into the trust's name.

We also throw in a few additional helpful tips so you can feel comfortable knowing you're taking the right steps in securing your legacy.

2. Sign, Date & Notarize Your Trust

Please note you will need to legalize your trust according to your state's laws in order to make it legally enforceable. This may include needing witnesses and/or notarization. Find out how to make your trust legal by referring to our "How to Make Your Wills & Trusts Valid in Your State" article.

3. Fund Your Trust: Transfer Property

Funding your trusts means legally transferring assets and property into the trust’s name to ensure seamless distribution of these assets to your beneficiaries after you are no longer here to enjoy them yourself.

Funding a trust may seem complicated but it’s all about asking the right questions to the right people. Please note not all assets need to be legally transferred into your trust. For instance, your family heirlooms, furniture, and electronics can simply be transferred by “assignment” to your trust, either within the document itself or in your Schedule A sheet. While trusts are quite versatile, there are certain assets that experts advise against placing inside trusts. Learn more about what should and shouldn’t go into your trust by reading our “Unlocking the Potential of Your Trust: What You Can Include.”

Transferring assets and property into a trust effectively means transferring ownership from your name to the trust’s name. Let’s go through each type of asset and how to transfer them.

Real Estate Property

In order to transfer your home or any other real estate property into your trust you will need a deed which is a document that facilitates the transfer of ownership. There are multiple types of deeds such as a “quitclaim deed”, which is the simplest and most common method that you can most likely complete yourself. Other types include a “warranty deed”, this type ensures you have a good title and may make it easier for your beneficiaries to sell the property later on. Please note we are not a law firm and cannot provide any legal advice. We advise you to consult an attorney with any specific questions you may have, such as which deed is best for you.

When transferring your property ownership, you should consult with your title insurance provider to get information regarding whether they require any changes. You should also contact your homeowner's insurance provider to indicate the change.

Having your real estate property in a trust may award you with a real estate tax exemption. Learn more and ensure it is recognized by contacting and showing documentation to taxing authorities. You may also discuss this with your accountant.

Vehicles

Please note not every state allows trusts to hold ownership of vehicles such as cars, trucks, boats, and more. To find out if yours does, we recommend you visit the DMV online or in person. It is also recommended that you contact your insurance company to ensure coverage will continue post-transfer, etc.

If you choose to proceed with an ownership transfer of your vehicle(s), you will need to complete a form with the appropriate DMV office.

Financial Assets

In order to transfer financial assets such as bank accounts, investments, stock, and bonds, you will have to contact each financial institution and request a form to complete. You may need to provide specific documentation to prove the trust’s existence.

Each time you transfer an asset, you should add it to your Schedule A form (provided to you when you download your trust as a PDF) to easily keep track of all that is held by your trust.

4. Keep Your Trust in a Safe Place

Your trust is an important document and you should keep it in a safe and accessible place. A trust can be stored wherever you feel it is safe. This could be a fireproof safe, a filing cabinet, or anywhere else you safeguard your documents. When choosing your secure place, keep in mind that you’ll want to ensure your trust is accessible by at least one person you trust. If the location requires a passcode, make sure to share it with said trusted person. This person could be your spouse, close friend, adult child, etc.

5. Update Your Plan When Needed

It’s important to understand that an estate plan is not a one-and-done type of thing. Life evolves all the time and your estate plan should too. Estate planning experts recommend that plans be updated at least every 3 to 5 years to account for changes. You should also update your estate plan when a big life moment occurs. Big life moments include acquiring a new financial account, getting married or divorced, having children and pets, buying or selling a home, owning a business, retiring, even having grandchildren, and more. These are great opportunities to revise your estate plan and make sure it reflects your latest life circumstances.

Another great perk of having a trust is easily being able to add new assets and properties as you acquire them. When acquiring a new asset, simply refer to the “Fund Your Trust” section above, and easily add it to your trust.

GoodTrust makes it easy for you to update your trust. You can simply log in, head to your estate planning dashboard, select the document you’d like to edit, complete your edits, download it, and follow the legalization process.

Properly creating, legalizing, and funding your trust is important to ensure its validity. A properly funded trust means a smooth distribution of assets. Protect your assets and your loved ones by creating your trust today. Get started with GoodTrust, here.

Please note, GoodTrust is not a law firm and cannot provide legal advice. If you have any concerns regarding specific assets or property, we suggest you consult with a qualified attorney. We encourage you to consider the above guidelines and to check your state laws before making any legal decisions.